Founded by UK qualified financial advisers Hoxton Capital Management offers a fresh approach with a dynamic energy that sets it apart from its competitors in the offshore marketplace. A dual resident and the other jurisdiction has a tax treaty with the UK the treaty divides the taxing rights over an.

Statutory Tax Rates On Capital Gains In Europe And The Us Download Scientific Diagram

Part of annual income which exceeds 62 80000 euro.

Latvia capital gains tax. Undistributed capital gains Form 2439 boxes 1a1d Schedule D. Also use Form 8949 Schedule D and the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet. Sale of real estate and apartments.

The amount chargeable to income tax as property income is the difference between the premium received and the amount charged to CGT 100000-78000 22000. Investment income and capital gains are normally taxed at a 30 flat rate. Uzbekistan Republic of Last reviewed 23 July 2021.

Documentary Stamp Tax Documentary stamp tax is around 15 and it is levied on the selling price or fair market value of the property whichever higher. Section 1221 is the principal code provision that determines what property is treated as a capital asset for income tax purposes. If you lived in the residence for at least two out of the last five years the property is considered a primary residence and you may qualify for a 250000 deduction 500000 for married couples from any gain you had on the sale of the property.

The capital gains tax rates shown in the map are expressed as the top marginal capital gains tax rates taking account of imputations credits or offsets. This full version contains the full text of the Model Tax Convention as it read on 21 November 2017 including the Articles Commentaries non-member economies positions the Recommendation of the OECD Council the historical notes and the background reports. If the capital gains tax rate varies in a country by type of asset sold the tax rate applying to the sale of.

Yes capital gains tax of 10 is payable on the gain from the disposal of real estate by residents and non-residents in Nigeria except where such gains are derived from the main or only private residence of the individual and provided that the real estate does not exceed one acre in size. These 20 stand for limited liability companies and limited partnership companies. Capital gains on Swedish real estate and tenant owners apartments.

Chapter 3 - Table 32 Total tax revenue in US dollars at market exchange rate Chapter 3 - Tables 37 to 314 - Taxes as of GDP and as of Total tax revenue Chapter 3 - Table 315 - Tax revenues of subsectors of general government as of total tax revenue. Partnerships is assessed at a rate of 376. Annual income up to 20 004 euro 20.

We therefore advise you to whitelist the IBFD Tax Research Platform in your installed ad blocker for proper access to IBFD content. The capital gains tax rates shown in the map are the top marginal capital gains tax rates levied on individuals taking into account exemptions and surtaxes. Gain or loss from sales of stocks or bonds.

The capital gain is as follows. Thank you for your support. There is no individual capital gains tax in Uruguay.

Capital element of the premium. If the capital gains tax rate varies in a country by type of asset sold the tax rate applying to the sale of listed shares after an extended period of time is used. Capital gains are subject to CIT taxed at 25 there is no corporate capital gains tax in Uruguay.

The corporate income tax rate in Iceland stands at 20 since 2011 one of the lowest in the world. As from 1 January 2019 a progressive rate is implemented for. Capital gains are subject to IRPF or IRNR taxed at 12 with some exceptions.

The capital element is 2 x 40-1 x 100000 78000. Calculating capital gains tax on your foreign home. Local transfer tax is 050 for properties located in provinces and 075 for properties located in cities and municipalities in Manila.

This publication is the tenth edition of the full version of the OECD Model Tax Convention on Income and on Capital. A capital gains tax CGT is a tax on the profit realized on the sale of a non-inventory assetThe most common capital gains are realized from the sale of stocks bonds precious metals real estate and property. We would like to show you a description here but the site wont allow us.

Hoxton Capital Management is a borderless independent financial advisory consultancy unrelenting in its commitment to safeguarding your financial future. Non-resident individuals are taxed on Swedish source gains eg. It defines capital assets to include all property held by a taxpayer regardless of the propertys relationship to a trade or business and then provides a list of exclusions.

Under president Bidens Build Back Better plan the capital gains tax rate could increase from 20 percent to 396 percent for Americans earning more than 1 million. Part of annual income which exceeds 20 00400 euro but does not exceed 62 800 euro 23. 1 Prior to the passage of the Tax.

Application of double tax treaties and treaty residence Where an individual is tax resident in the UK and also tax resident in another jurisdiction ie. Corporate income tax for other types of legal entities eg. Local Transfer Tax.

Not all countries impose a capital gains tax and most have different rates of taxation for individuals and corporations. A tax rate of 22 applies to the sale of private real property and tenant owners apartments. Capital gains tax 18 20 22 Corporate tax.

However venture capital especially smaller funds can still take advantage of two provisions that encourage investment into new companies.

Immovable Property Where Why And How Should It Be Taxed Suerf Policy Notes Suerf The European Money And Finance Forum

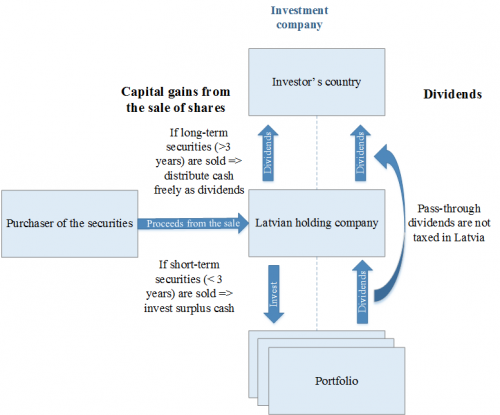

New Corporate Income Tax In Latvia How To Benefit From It

Tax Revenue Statistics Statistics Explained

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Tax Revenue Statistics Statistics Explained

The Tax Reform S Effect On The Capital Gains Tax For Us Expats Expat Tax Professionals

Latvia Tax Income Taxes In Latvia Tax Foundation

How Does The Covid 19 Economic Crisis Affect Health Financing And What Are The Implications For Future Health Budgets Cross Country Analysis

Canada Capital Gains Tax Attribution Rules In Canada Versus The Us

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/5JWD7KYQBNUOC3YHHMUAEEDHCU.jpg)

Mary Holm Don T Panic Over Cgt On Second Homes Nz Herald

New Corporate Income Tax In Latvia How To Benefit From It

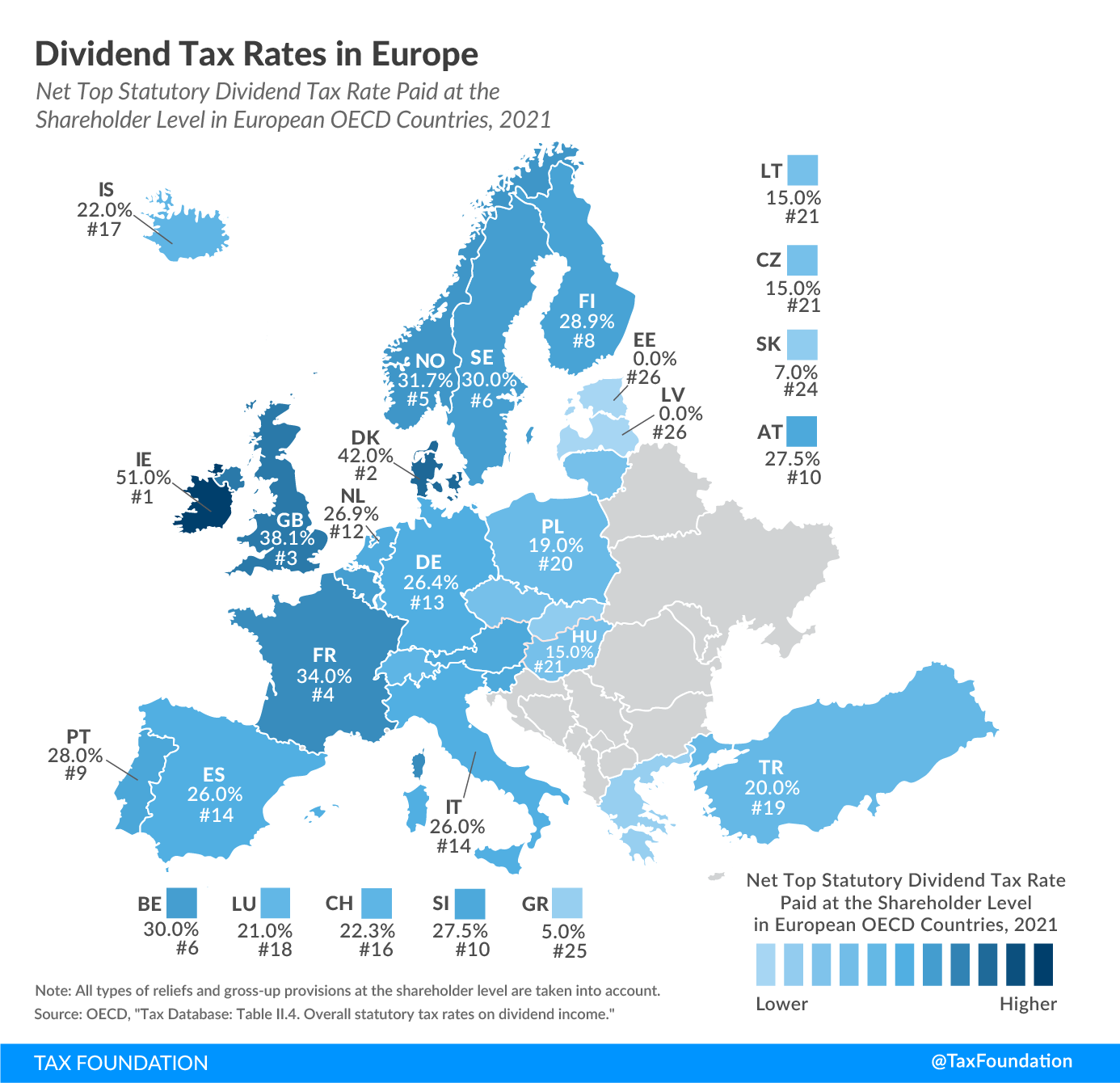

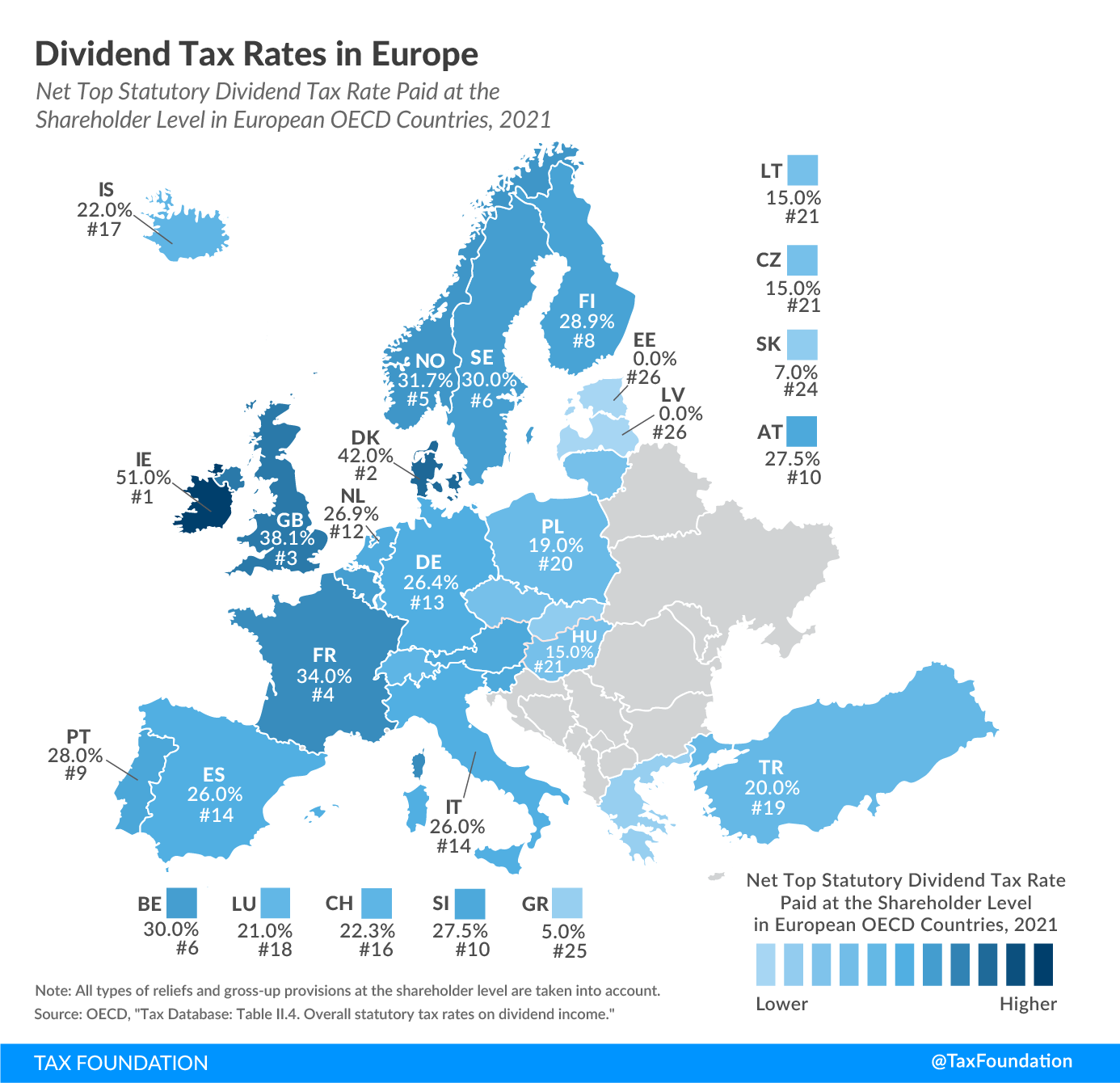

Dividend Tax Rates In Europe 2021 Dividend Tax Rates Rankings

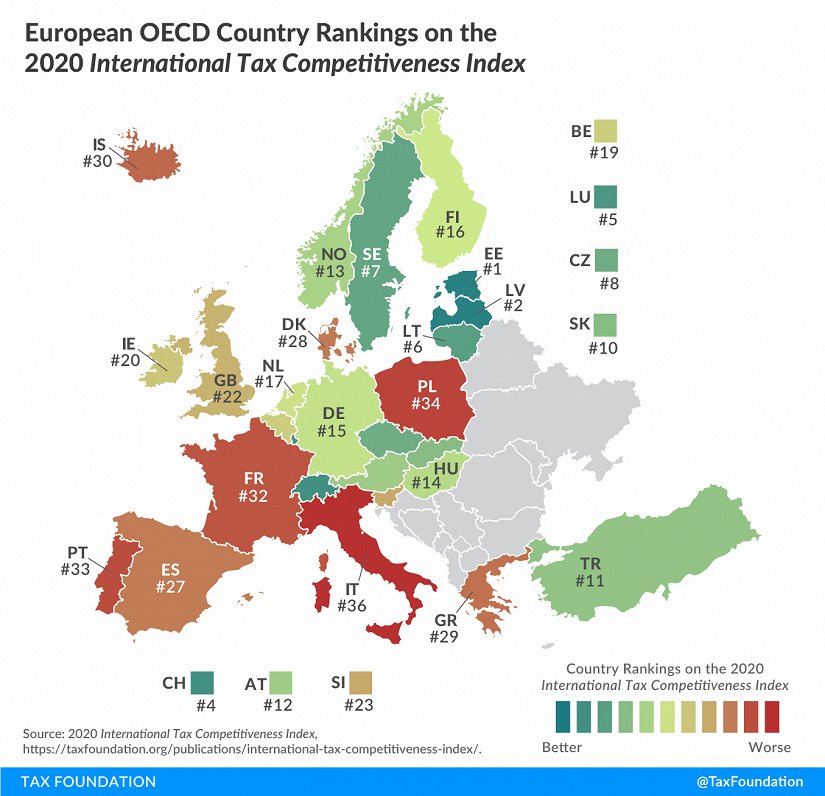

Latvia S Tax Code Gets High International Ranking Again Article

Latvia S Tax Code Gets High International Ranking Again Article

Taxation Of Capital Gains In Developing Countries In Imf Staff Papers Volume 1968 Issue 002 1968